The UK is looking to develop closer economic ties with the Indo-Pacific and Indonesia is one of its main partners in Southeast Asia. The two countries are working to strengthen trade and investment relations, particularly in the fields of education, health care and infrastructure development.

The UK and Indonesia have maintained diplomatic ties since 1949, and bilateral trade is expected to exceed $2 billion by 2021. Before the outbreak, annual bilateral trade was around $3.8 billion.

Indonesia has trade earnings of over $2 billion by 2021 in footwear products ($231 million), wood and wood products ($191 million), animal and vegetable fats and oils ($94 million) , lighting panels and prefabricated buildings ($94 million, $94 million, $78 million) and furniture ($78 million).

British exports to Indonesia that same year included machinery, nuclear reactors and boilers ($150 million), vehicles and trams ($104 million), timber ($99 million), pharmaceuticals ($65 million), and steel products ($ 59 million).

The UK is seeking closer economic and security ties with the Indo-Pacific region and plans to spend up to £500m ($606m) on green infrastructure projects in Indonesia, UK, Vietnam, Philippines, Cambodia and Laos. 5 years. The UK also wants to join the Comprehensive and Progressive Transpacific Partnership Agreement (CPTP) and will be the first European country to do so.The UK sees Indonesia as a key partner in Southeast Asia as the archipelago is projected to become the world's seventh largest economy by 2030, with 135 million people expected to fall into the middle demographic. In addition, there are $1.8 trillion worth of investment opportunities, ranging from consumer services to agriculture.

Joint Economic and Trade Committee

Indonesia and the UK announced the formation of a Joint Economic and Trade Committee (JETCO) and a Joint Trade Review (JTR) to further strengthen trade and investment relations. JTR has identified nine key areas to improve collaboration, including renewable and green energy, food and beverage, health and life sciences, education and training, agriculture and finance, and professional services.

Opportunities for UK companies in Indonesia

Indonesia offers great opportunities for UK investors as it has the largest economy in ASEAN, a young workforce and a growing middle class.

healthcare and pharmacy

Given the size of its market, the Indonesian healthcare sector presents lucrative opportunities for foreign investors.

Since the introduction of the Universal Health Care Scheme (BPJS) in 2014, annual public spending on healthcare has increased and, at nearly 200 million people, is the highest in the world. Every citizen and foreigner is required to participate and companies must enroll their employees in the program and pay a percentage of the prize.

The increase in healthcare spending will impact key sub-sectors such as the medical device industry, which is estimated to be worth $4.5 billion in 2019. Most of that $2.8 billion is imported. Indonesia mainly imports high-tech medical equipment such as PET-CT scanners and intensive care equipment and exports low-tech equipment such as gloves and syringes.

The pharmaceutical industry is dominated by generic drugs (70%), the rest are over-the-counter drugs. The BPJS program has increased generic drug sales by more than $700 million in the country.

infrastructure construction

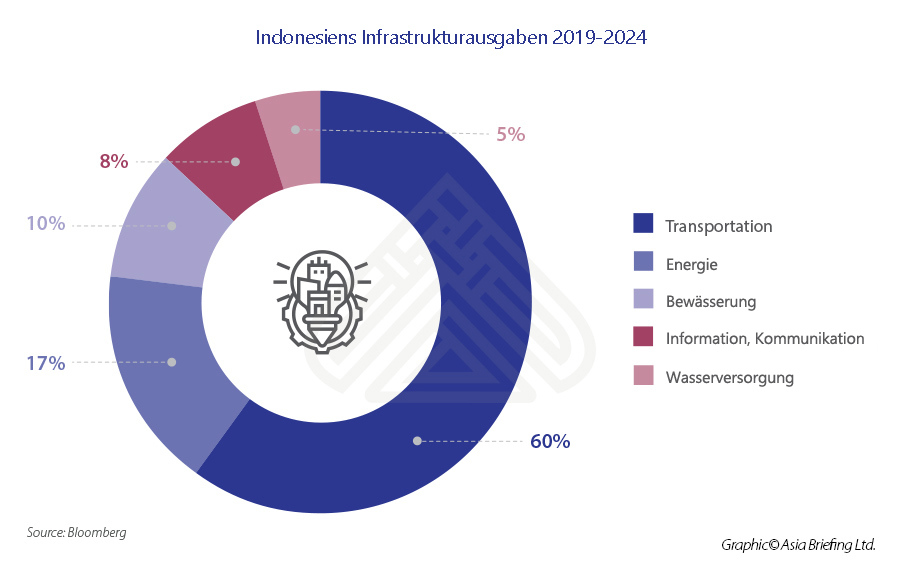

Infrastructure has been at the forefront of Joko Widodo's government since 2014. As announced by the president in late 2021, his government has built 1,640 km of toll roads and 4,600 km of non-road roads over the past six years. In addition, 15 new airports are under construction and 38 expansions and renovations are underway. By 2024, 65 new dams will be built across the country.

In the years between 2022 and 2024, Indonesia needs about US$445 billion in infrastructure investments.

Indonesian digital economy

Indonesia wants to use the forum to promote equal access to technology and capital, especially for new tech startups. Indonesia's digital economy is projected to grow to more than $125 billion by 2025.

The country is Southeast Asia's largest and fastest-growing internet economy – more than 170 million Indonesians will have access to the internet by 2020, and 10 percent will shop online. E-commerce is a major force in changing the retail landscape in Indonesia, and Indonesia's gross value of goods (GMV) ranks third in the world at US$40 billion, surpassing India with a value of 38 billion dollars.

As such, Indonesia offers tremendous digital opportunities for foreign investors, particularly in the e-commerce, fintech and Internet of Things (IoT) sectors. To fully exploit this growth potential, the Indonesian government enacted new digital and e-commerce tax laws in 2020, signaling an improving regulatory landscape. This is supported by the country's dynamic tech sector, which is one of the best startups in the world.

education

With around 55 million students, Indonesia has one of the largest education systems in the world. Additionally, Indonesians with strong economies have more income that can be spent on education, thereby increasing public demand for higher education.

The country's higher education sector is projected to generate $118 billion in revenue by 2025, providing ample opportunity for UK educational institutions to enter the Indonesian education market as the UK is renowned for the quality of its universities and vocational schools.

Indonesian companies show problems in recruiting employees at both managerial and technical levels. According to the 2020 OECD report, only 11.9% of adults have completed secondary education, below the OECD average of 44%.

To address this problem for Indonesia, it is essential to improve the performance of higher education institutions. Thus, the government plans to add 57 million skilled workers to the economy by 2030. To achieve this goal, the government has set specific targets for the education sector, including:

- increase the number of science and engineering graduates;

- Improve the science and technology of local universities through international cooperation;

- increase job opportunities for graduate and professional graduates; And

- Improving the quality of research and innovation.

related reading

about us

The ASEAN briefing was prepared by Dezan Shira and Associates. The firm supports foreign investors throughout Asia and has offices throughout ASEAN, including Singapore, Hanoi, Ho Chi Minh City and Da Nang in Vietnam, Munich and Essen in Germany, Boston and Salt Lake City in the United States. United and Milan. Conegliano and Udine in Italy, Jakarta and Batam in Indonesia. We also have offices in Malaysia, Bangladesh, the Philippines and Thailand as well as our own operations in China and India. Contact us at asia@dezshira.com or visit our website www.dezshira.com.